Jim McHale of Memoori takes a look at the internet of things in buildings (BIOT).

The BIOT provides a very different set of challenges compared to those faced in the consumer IOT world, which inevitably attracts most of the media’s column inches.

Overall, connectivity penetration rates across all building systems are currently only around 16 percent. This connectivity penetration rate will rise steadily over the coming years, and with it the market potential for BIOT. It will inevitably have to coexist with extant equipment and data networks for a significant length of time.

According to a new report from Memoori, the global market for the BIOT will increase from approximately $23 billion in 2014 to more than $85 billion in 2020.

However, the cost of replacing hardware and software in buildings is often simply too prohibitive. As such, the BIOT will have to accommodate disparate technologies, cooking up a networking “protocol soup” with ingredients like BACnet, LonWorks, KNX and Modbus.

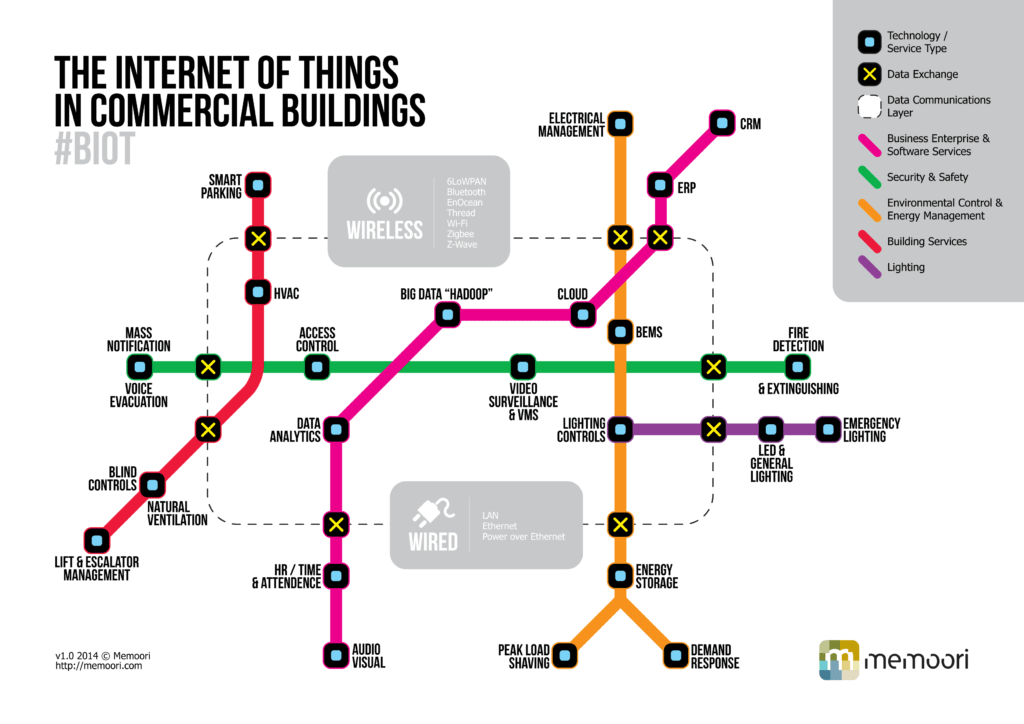

Here’s what that might look like:

Jim Norton, Chair of the U.K. Spectrum Policy Forum, recently commented that “the acceleration toward total mobility is eliminating the distinction between fixed and mobile communications to become just connectivity.”

Wi-Fi, ZigBee, Bluetooth, Z-Wave, Thread, 6LoWPAN and others can all provide wireless data communications in buildings and 3G/4G (at some point, 5G and Weightless) outside. The line between wired and wireless communications continues to blur, adding even more ingredients to the soup.

“The question now is really, how long is the radio link into the fixed network backhaul and what implications does that have for the fixed networks?” said Norton.

With the coming explosion of connected sensors and devices, it is incumbent on the smart building industry to connect different data protocols in a seamless and secure way.

Increasingly, the value in the Internet of things is more about data than devices. Collecting data from more building services and equipment will provide a much more granular view of exactly how each building is performing.

Building equipment manufacturers and providers must start selling systems that collect, store and analyze data in the cloud, so they can use it to provide better operational efficiency for building owners and occupiers.

Jim McHale founded Memoori in 2008. It is a consultancy based in London that provides market research, business intelligence and financial deal tracking services to clients across several industries. Jim wrote this blog post for CENSIS in May 2015.

Twitter @Memoori